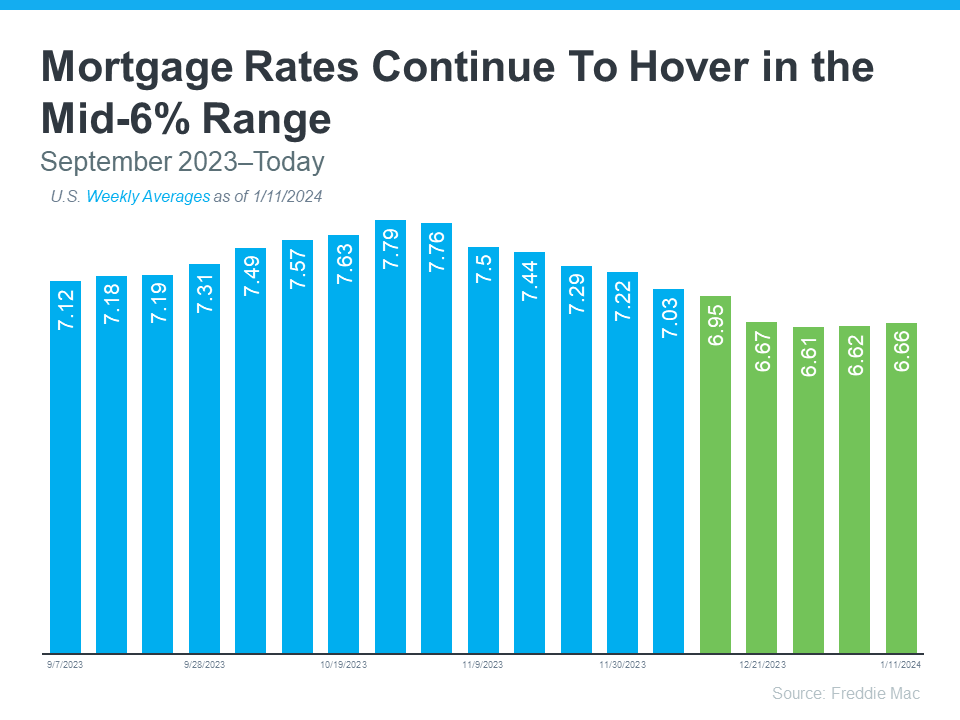

If you’ve been holding off on selling your house to make a move because you felt mortgage rates were too high, their recent downward trend is exciting news for you. Mortgage rates have descended since last October when they hit 7.79%. In fact, they’ve been below 7% for over a month now (see graph below):

And while they’re not going back to the 3% we saw during the ‘unicorn’ years, they are expected to continue to go down from where they are now in the near future. As Dean Baker, Senior Economist at the Center for Economic Research, explains:

“It also appears that mortgage rates are now falling again. They will almost certainly not fall to pandemic lows, although we may soon see rates under 6.0 percent, which would be low by pre-Great Recession standards.”

Here are two reasons why this recent trend, and the expectation it’ll continue, is such good news for you.

You May Not Feel as Locked-In to Your Current Mortgage Rate

With mortgage rates already significantly lower than they were just a few months ago, you may feel less locked-in to the current mortgage rate you have on your house. When mortgage rates were higher, moving to a new home meant possibly trading in a low rate for one up near 8%.

However, with rates dropping, the difference between your current mortgage rate and the new rate you’d be taking on isn’t as big as it was. That makes moving more affordable than it was just a few months ago. As Lance Lambert, Founder of ResiClub, explains:

“We might be at peak “lock-in effect.” Some move-up or lifestyle sellers might be coming to terms with the fact 3% and 4% mortgage rates aren’t returning anytime soon.”

More Buyers Will Be Coming to the Market

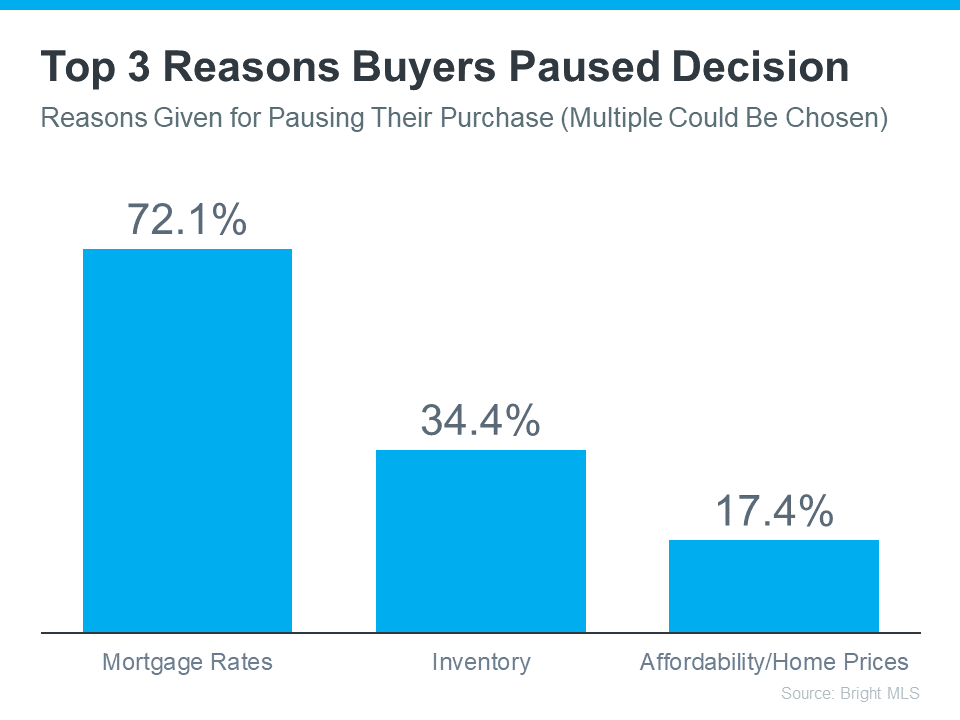

According to data from Bright MLS, the top reason buyers have been waiting to take the plunge into homeownership is high mortgage rates (see graph below):

Lower mortgage rates mean buyers can potentially save money on their home loans, making the prospect of purchasing a home more attractive and affordable. Now that rates are easing, more buyers are likely to feel they’re ready to jump back into the market and make their move. And more buyers mean more demand for your house.

Bottom Line

If you’ve been waiting to sell because you didn’t want to take on a larger mortgage rate or you thought buyers weren’t out there, the recent decline in mortgage rates may be your sign it’s time to move. When you’re ready, let’s connect.