As we celebrate Black History Month, we honor and recognize the past and present experiences of Black Americans. A significant part of this experience is investing in a home of their own. While equitable access to housing has come a long way, the path to homeownership is still steeper for households of color. It’s an important experience to talk about, along with how working with the right real estate experts can make all the difference for diverse homebuyers.

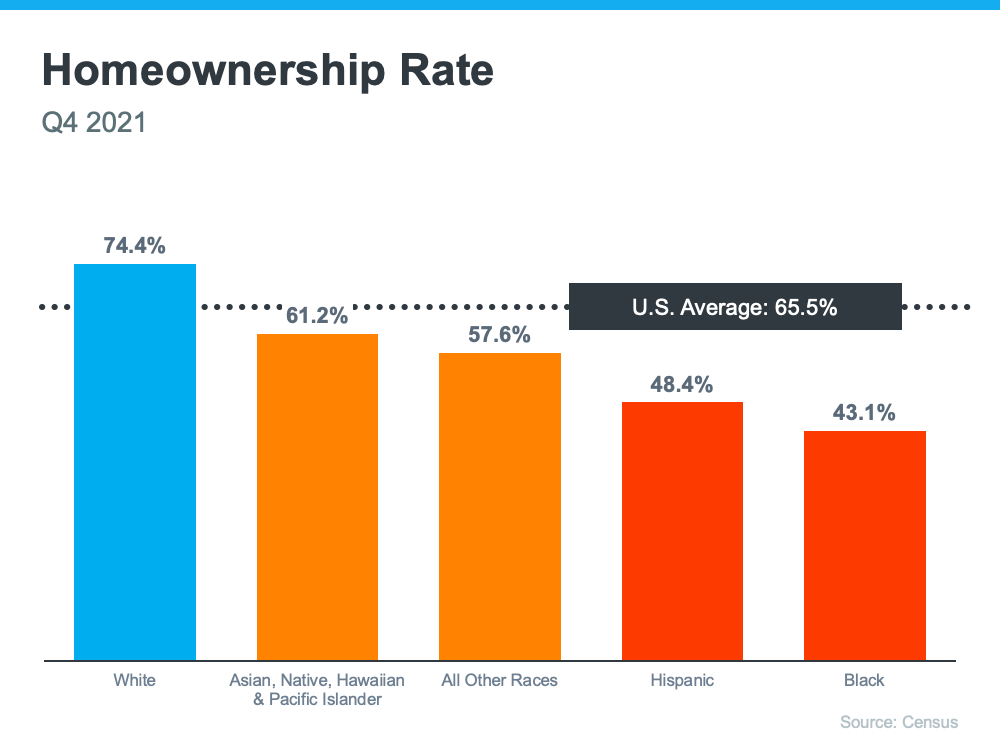

We know it’s a more challenging journey to achieve homeownership for some because there’s still a measurable gap between the overall average U.S. homeownership rate and that of non-white groups. Today, the lowest homeownership rate persists in the Black community (see graph below):

Homeownership is an essential piece for building household wealth that can be passed down to future generations. However, there are obstacles in the homebuying process that can negatively impact certain racial and ethnic groups, including the Black community. This can delay or prevent many from achieving homeownership, challenging their ability to grow their net worth. A report by Vanessa G. Perry of the George Washington University School of Business and Janneke Ratcliffe of the Urban Institute explains:

“. . . households of color have much lower homeownership rates than white households and consequently hold, at the median, just one-eighth the wealth of white households.”

On top of that, when Black households do become homeowners, research shows they pay more for those homes overall than the average household. Raheem Hanifa, a Research Analyst for the Joint Center for Housing Studies of Harvard University, tells us:

“Black homeowners not only have primary mortgages with higher interest rates than white homeowners with similar incomes, they also have higher interest rates than white homeowners with substantially lower incomes, . . . Black homeowners have experienced systemic barriers to homeownership and wealth-building opportunities that have limited their ability to access credit, which is a key component in receiving low mortgage interest rates.”

For Black homebuyers, the inequity that remains in housing can be a point of pain and frustration. That’s why it’s so important for members of diverse groups to have the right team of experts on their sides throughout the homebuying process. These professionals aren’t only experienced advisors who understand the market and give the best advice. They’re also compassionate allies who will advocate for your best interests every step of the way.

Bottom Line

Opportunities in real estate improve every day, but there are still equity challenges that many face. Let’s connect to make sure you have an advocate on your side as you walk the path to homeownership.