In today’s real estate market, low inventory and high demand are driving up home prices. As many as 54% of homes are getting offers over the listing price, based on the latest Realtors Confidence Index from the National Association of Realtors (NAR). Shawn Telford, Chief Appraiser at CoreLogic, elaborates:

“The frequency of buyers being willing to pay more than the market data supports is increasing.”

While this is great news for today’s sellers, it can be tricky to navigate if the price of your contract doesn’t match up with the appraisal for the house. It’s called an appraisal gap, and it’s happening more in today’s market than the norm.

According to recent data from CoreLogic, 19% of homes had their appraised value come in below the contract price in April of this year. That’s more than double the percentage in each of the two previous Aprils.

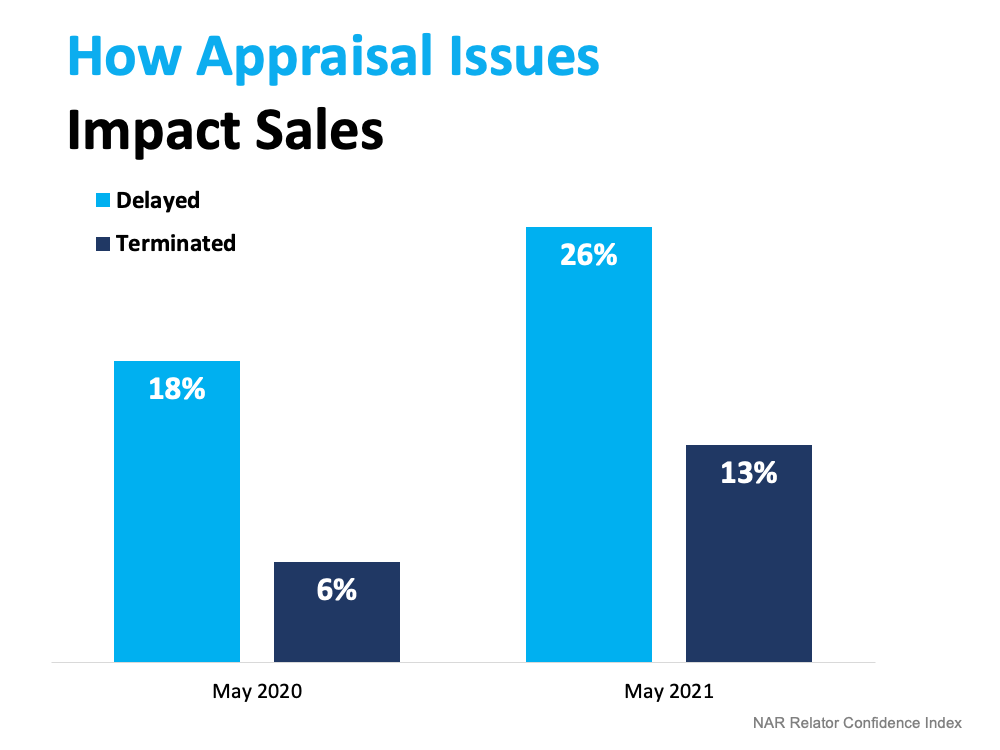

The chart below uses the latest insights from NAR’s Realtors Confidence Index to showcase how often an issue with an appraisal slowed or stalled the momentum of a house sale in May of this year compared to May of last year. If an appraisal comes in below the contract price, the buyer’s lender won’t loan them more than the house’s appraised value. That means there’s going to be a gap between the amount of loan the buyer can secure and the contract price on the house.

If an appraisal comes in below the contract price, the buyer’s lender won’t loan them more than the house’s appraised value. That means there’s going to be a gap between the amount of loan the buyer can secure and the contract price on the house.

In this situation, both the buyer and seller have a vested interest in making sure the sale moves forward with little to no delay. The seller will want to make sure the deal closes, and the buyer won’t want to risk losing the home. That’s why it’s common for sellers to ask the buyer to make up the difference themselves in today’s competitive market.

Bottom Line

Whether you’re buying or selling, let’s connect so you have an ally throughout the process to help you navigate the unexpected, including appraisal gaps.