If you own a home in Orange County, there’s a good chance you locked in a fantastic mortgage rate a few years ago. Maybe it’s in the 2s or low 3s. And every time you think about moving to a home that fits your life better, you hit the same wall:

“I don’t want to give up this rate.”

Totally understandable. That payment has been one of your best financial wins.

But a great rate on a home that no longer fits you isn’t really a win anymore.

I talk every week with owners in Irvine, Lake Forest, Mission Viejo, Aliso Viejo, Tustin and Anaheim Hills who are wrestling with that exact trade-off. Their families, commutes, and priorities have all changed-while their house has stayed the same.

More and more of them are deciding that being “stuck” in the wrong home feels worse than giving up the old rate.

The “Locked-In” Feeling vs. What’s Really Happening in OC

Economists call it the “lock-in effect”: homeowners hesitate to sell because buying their next place likely means taking on a higher mortgage rate.

But if you look at what’s actually happening in Orange County, people are still moving.

Over the past year, OC has seen roughly 1,100 to 2,800 new listings come on the market each month, with around 2,100 new homes listed most recently. That’s not a frozen market-that’s thousands of owners deciding their next chapter matters more than keeping their old rate.

Some of those sellers are relocating out of the area, but many are simply moving up or making a lifestyle shift within Orange County.

A Quick Snapshot of Today’s Market

Before you decide whether to stay or go, it helps to understand the local numbers you’re working with.

- Prices: In Orange County, the median listing price has mostly hovered between about $1.2M and $1.3M, landing around the mid-$1.2M range recently. That usually means strong equity if you bought several years ago.

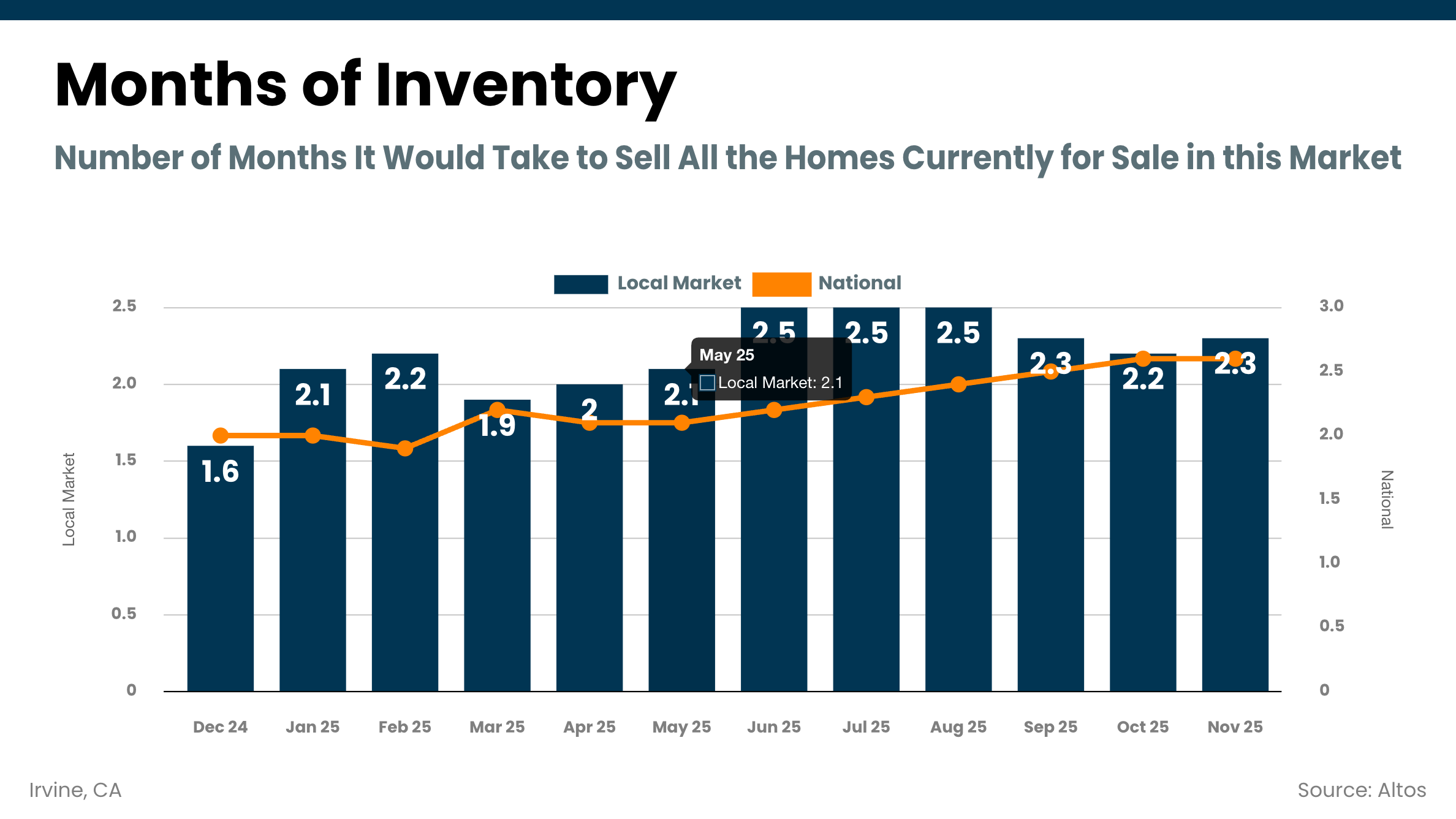

- Inventory: In Irvine, new listings typically run around 200-350 homes per month, with slower months closer to 100+ and peak months pushing 350+. Months of inventory has generally sat between about 1.6 and 2.5 months, which is still a seller-leaning market.

- Pace: Irvine’s median days on market has ranged from the mid-30s up into the low-60s over the past year, and more recently it’s been closer to about two months from listing to an accepted offer (days on market). After that, the escrow period adds additional time before closing.

Bottom line: homes in good condition and priced correctly in areas like Irvine, Mission Viejo and Aliso Viejo are still selling-just with a bit more breathing room than during the frenzy.

When Your Life Outgrows Your Low Rate

So if the market is still moving, why are some owners deciding to move despite their low rate? Because life doesn’t stand still in Orange County.

Common stories I hear from OC move-up sellers:

- Outgrowing the home – You bought a townhome in Irvine or a smaller single-family in Lake Forest when it was just the two of you. Now there are kids, pets, or a live-in parent, and you’re tripping over each other.

- Remote work and lifestyle changes – You don’t commute as much and want a quieter neighborhood, more space, or better amenities-maybe trading a small place near the office for a larger home in Mission Viejo or Anaheim Hills.

- Household changes – Marriage, divorce, or blending families can make your current layout awkward.

- Ready for your “next 10-year home”, not your pandemic home – The rate is great, but the home was chosen quickly or under pressure. Now you’re thinking long term and realizing this may not be where you want to spend the next decade.

If one or more of these feels familiar, your low rate might be keeping you in a home that no longer supports the life you’re actually living.

How OC Sellers Are Making the Numbers Work

Giving up a low rate doesn’t have to mean making an unwise financial move. Here are a few ways local sellers are approaching it:

- Letting equity work for them – With values in that roughly $1.2M-$1.3M median list price range, many OC owners have built up significant equity. That can boost your down payment and give you more flexibility on price and neighborhood.

- Trading up in the same market – When you sell and buy within Orange County-say selling in Aliso Viejo and buying in Tustin-you’re moving within the same overall price and rate environment. If values rise over time, both your current home and your next one usually move in the same direction.

- Using today’s more balanced pace – With days on market often running several weeks to a couple of months before an accepted offer, there’s more room to coordinate timing, explore rent-backs, or structure your move so it fits your real-life schedule.

Everyone’s numbers are different, so it’s important to run your specific scenario with a lender and your agent. But many Orange County sellers are finding the math is less scary than they expected once they actually see the numbers.

A Few Questions to Help You Decide

Instead of asking only, “Should I give up my low rate?” try asking:

- Is my current home limiting my daily life?

- Would a move within Orange County meaningfully improve my lifestyle?

- Do I have enough equity to comfortably move up?

- Does staying just for the rate make sense over the next 5-10 years?

If you’re answering “yes” to the lifestyle questions and “no” to that last one, it may be time to at least explore your options.

A Local, No-Pressure Way to Explore Your Options

You don’t have to decide today to list your home. But you can get clarity.

A simple, low-pressure move-up planning conversation might include:

- A personalized value check for your current home in your specific city-whether that’s Irvine, Lake Forest, Mission Viejo, Aliso Viejo, Tustin or Anaheim Hills.

- A quick look at financing options with a trusted local lender so you can see how your equity and today’s rates might play out.

- A shortlist of realistic move-up options in the OC cities that match your lifestyle goals.

No pressure, no obligation-just real numbers and options so you can make an informed decision.

Ready to Find Out If You’re Really “Stuck”?

If you’re an Orange County homeowner sitting on a fantastic rate but living in a home that no longer fits your life, it might be time to rethink what “stuck” really means.

If you’d like a local, data-driven look at your options, reach out. We’ll walk through your home’s value, your equity, and possible move-up paths in cities like Irvine, Lake Forest, Mission Viejo, Aliso Viejo, Tustin and Anaheim Hills, so you can decide, with confidence, whether staying or moving is the better next step.