Buying a home in Orange County is not cheap. Between Irvine, Costa Mesa, Mission Viejo, and the beach cities, prices stay high and the homes that look perfect on day one often attract multiple offers. That does not mean you have to overpay. Some of the best opportunities in this market come from properties that have been sitting for a while or have already had a price cut.

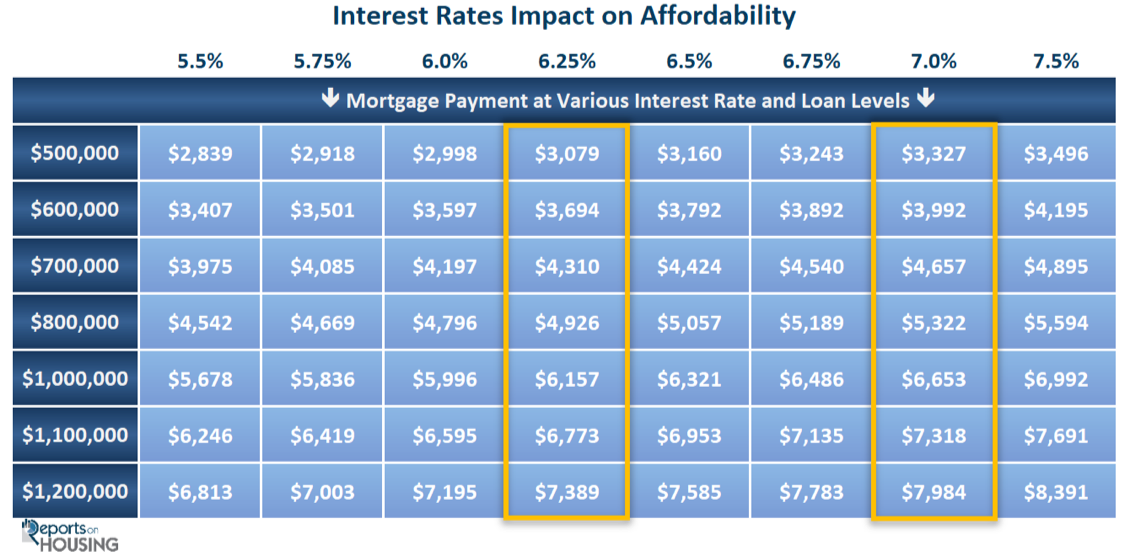

At the same time, the math is starting to move in buyers’ favor. Recently, 30 year mortgage rates have been hovering between about 6 and 6.5 percent, the lowest stretch in more than a year and roughly three quarters of a percent lower than last fall. On a one million dollar loan, dropping from 7 percent to about 6.25 percent saves roughly five hundred dollars per month. That improvement in affordability matters when you combine it with the right strategy.

When a listing lingers, most buyers ignore it and move on to the next shiny new property. Many sellers do not have that luxury. They get more realistic, more flexible, and more open to negotiation. If you know how to target those homes, you can often buy the same house for less than what other people are paying.

The Opportunity: Stale Listings In A Low Inventory Market

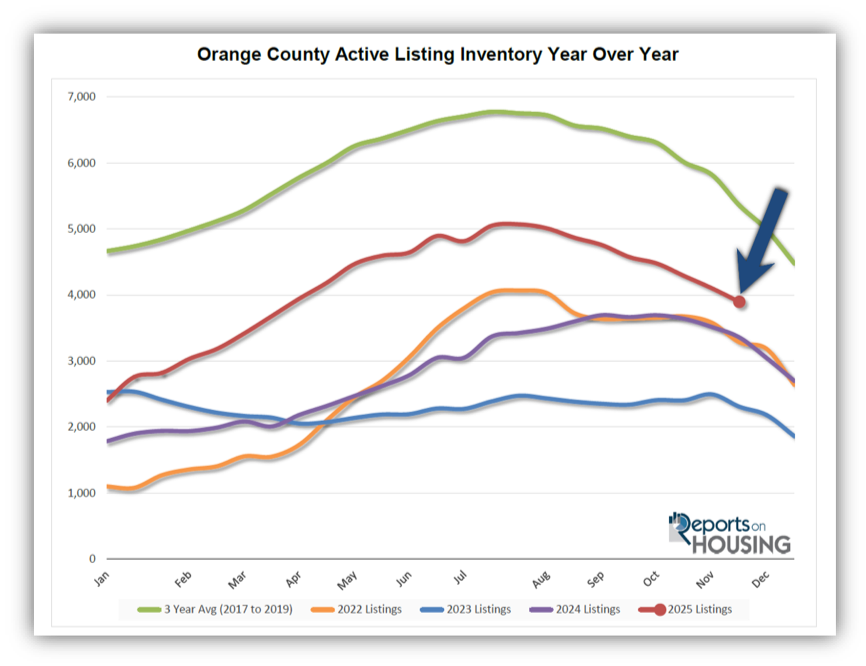

Orange County is still undersupplied. Right now there are only about 3,900 active listings in the entire county, which is more than a thousand homes fewer than the average before the pandemic. That tight inventory is why nice, well priced homes can still move quickly.

But not every home is perfectly priced. Some sellers test the market too high, or their home needs more work than buyers expect. That is where the opportunity shows up.

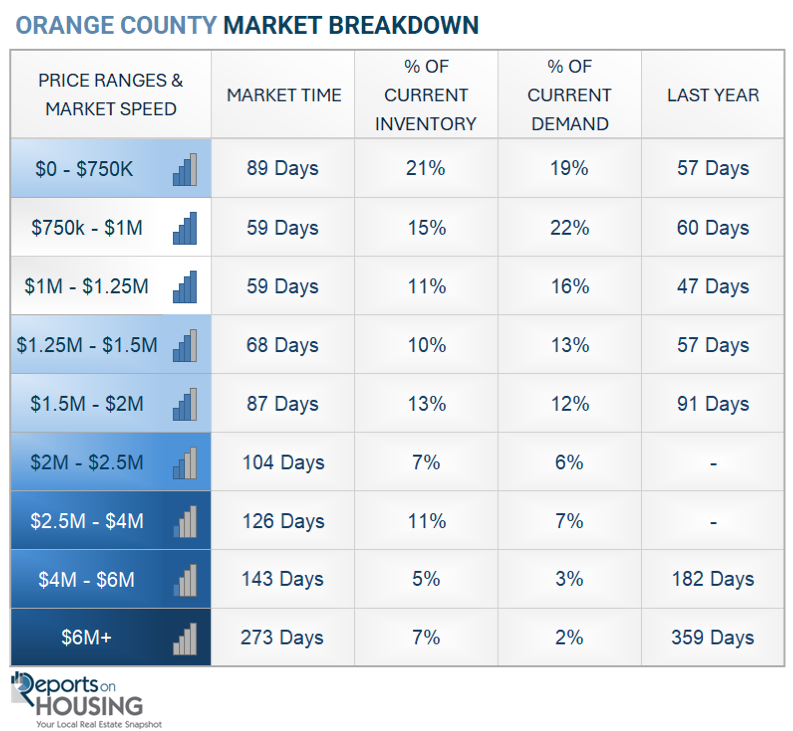

Countywide, the Expected Market Time, which is the number of days it would take to sell all active listings at the current pace, is sitting at about eighty four days. Condos and townhomes are a bit slower, near ninety four days, while detached homes are closer to seventy seven days. Homes that sit much longer than those ranges often need a price adjustment or a buyer who is willing to look past cosmetic issues.

In other words, even in a low inventory environment there are still slow movers, and that is exactly where buyers often have more leverage.

The Tactic: Zero In On Slow Moving Orange County Listings

Your agent can set up searches that specifically flag the homes with the most negotiating power. In Orange County that usually means:

- Condos and townhomes in areas like Irvine, Tustin, and Lake Forest that have been on the market longer than the normal days on market for that neighborhood.

- Detached homes in older tracts that have already had one or more price reductions.

- Properties that went under contract, fell out of escrow, and came back on the market.

These are the situations where buyers tend to have more leverage. When there are fewer active buyers walking through and a home has already missed its big debut weekend, sellers are more likely to listen to serious offers or agree to credits and repairs in order to get to the closing table.

Buyer demand is still below normal. There are only about 1,400 pending sales countywide over a recent thirty day stretch, which is roughly forty percent lower than a typical pre pandemic fall. Fewer active buyers plus a home that has been sitting longer than average is exactly the combination that supports a better deal.

How To Work These Opportunities In Practice

Here is how this strategy looks when you are actively shopping in Orange County:

- Stop obsessing over the brand new listings.

Everyone sees those first, especially in popular areas like Irvine, Huntington Beach, and Rancho Santa Margarita. Competition is highest and sellers are the least flexible in the first few days. - Ask your agent for a slow movers list every week.

Have your search set to flag homes that have been on the market longer than the typical days on market for that city, or that just took a price cut. That is where motivated sellers start to show up. - Make strong but realistic offers.

The goal is not to steal a house. You are trading certainty and clean terms for a better price. A well written offer with strong financing, flexible timing, and reasonable contingencies often justifies a meaningful discount from the original list price, especially when the seller has already been sitting for a while. - Use terms, not only price.

In Orange County, where many buyers are payment sensitive, seller credits and interest rate buydowns can matter as much as the sticker price. A closing cost credit or a rate buydown can effectively save you tens of thousands of dollars over time without the seller feeling like they are giving the home away.

What A Small Discount Really Means In Our Price Range

On paper, a four to six percent discount from the original list price might not sound dramatic. In real dollars, at Orange County price points, it is a big deal.

Take a home that was initially listed at $900,000:

- A four percent discount brings the price down to $864,000.

- That is $36,000 less in the price you pay and less cash needed for your down payment and closing costs.

- Your monthly payment becomes more manageable for the life of the loan, especially when you combine the lower price with today’s roughly six percent range rates instead of the seven percent range we saw not long ago.

Now add a seller credit. If the seller also agrees to give you a two percent credit toward closing costs, that is another seventeen to eighteen thousand dollars you do not have to bring to the closing table. For many buyers, that is the difference between “we wish we could buy” and “we can actually do this.”

This is how focusing on slower moving listings can quietly put tens of thousands of dollars back in your column, even if headline prices in Orange County still look high.

Bottom Line For Orange County Homebuyers

If you want the best deal you can get in this market, stop chasing only the newest and prettiest listings at the top of every search result.

Instead, target the homes that have:

- Been sitting longer than average for that neighborhood, or

- Already taken a noticeable price cut, or

- Come back on the market after a previous contract fell apart.

Those are the properties where motivated sellers and serious buyers usually find common ground on price and terms.

If you want help finding those opportunities in your preferred Orange County cities, and understanding what a smart offer looks like on each one, reach out and I will walk you through it step by step.